Relocating for work or life adventure should expand your possibilities—not your health risks. Yet for many expatriates, the moment they cross a border, familiar healthcare pathways vanish. Networks change, reimbursement rules shift, and what felt comprehensive at home suddenly reveals gaps abroad. “Global reach” is only half the promise; you also need care that is usable, affordable, and culturally attuned wherever you actually live, work, and travel.

The problem with “good enough” plans

The challenge is not merely to hold a policy, but to hold the right one—configured to your geography, family stage, and risk profile.

Basic, domestic-style cover rarely travels well. Employer plans may be negotiated with cost first, not continuity. And comparison by headline price tends to ignore the fine print that decides outcomes: pre-authorisations, direct-billing networks, evacuation protocols, and waiting periods.

The difference between a confident appointment and a months-long claim chase is almost always in the details.

Why a specialist broker matters

This is where a specialist, expat-first broker makes the difference. Expatmedicare was built around the reality that mobility is messy and that healthcare should not be.

Rather than forcing your life to fit a generic policy, they map coverage to your actual residency pattern, travel cadence, and dependent needs. That means advising on policy areas that most buyers overlook—like regional zones of cover, deductible design that matches local price levels, and the subtleties of underwriting for pre-existing conditions—so you avoid expensive surprises later.

“Global reach, local care” in practice

“Global reach, local care” is more than a slogan.

It means you have the breadth to see a specialist in one country and the practical ability to follow up in another—without starting from scratch. It means direct-billing options in the clinics you will actually visit, not just a theoretical list. It means claims support in your language and time zone, and guidance on how the local system works: when to go private, when to use public services, and which documents unlock smooth reimbursements.

Regulations, regions, and real-world pitfalls

The biggest pitfalls are jurisdictional. Regulations differ by region; so do customary medical fees, insurer provider contracts, and even the availability of certain treatments.

A plan that thrives in Southeast Asia may feel restrictive in Western Europe without the right zone upgrades. Maternity benefits can be generous in one market and heavily conditioned in another. Mental health benefits are broadening, but coverage caps vary widely.

The right broker helps you navigate these moving parts with an eye on both compliance and real-world usability.

The non-negotiables of comprehensive cover

Start with the foundations of comprehensive international health insurance.

Inpatient cover should be non-negotiable. Outpatient care is where most day-to-day use happens, so structure limits and co-pays to match local price norms. Add evacuation and repatriation for medical events beyond local capacity—particularly important in remote postings or during regional instability. Consider dental and vision if you have children. If starting or growing a family, understand maternity waiting periods and caps well before you need them.

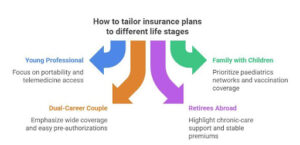

Profiles and priorities: tailoring by life stage

Your profile matters.

- A young professional on a two-year rotation may value portability and a lean outpatient rider with telemedicine access.

- A family with school-age children might prioritise strong paediatrics networks, vaccination coverage, and predictable co-pays.

- Dual-career couples traveling frequently across regions need a wider zone of cover and easy pre-authorisations across borders.

- Retirees abroad may focus on chronic-care support, stable premiums over time, and facilities equipped for complex diagnostics.

Networks and navigation: the care you actually use

Provider access is equally decisive.

Direct-billing means the clinic invoices the insurer, not you—essential for high-cost imaging or hospital admissions. Where reimbursement applies, fast digital claims and clear documentation requirements spare you administrative strain. Look for second-opinion services for complex diagnoses and case management that proactively coordinates care.

These are the quiet features that translate policy language into lived peace of mind.

Premiums with purpose: better ways to control costs

Cost control should be strategic, not simplistic. Excessive deductibles can deter needed care; better to calibrate co-pays and caps to your utilisation rather than chase the lowest premium.

Some policies reward healthy behaviours or include preventive screenings that catch issues early. Remote GP triage prevents unnecessary specialist visits. And when relocating, review network tiers; a slight premium increase may unlock direct-billing hospitals that save money and stress over a full year.

Sensitive benefits: mental health, maternity, chronic care

Pay attention to sensitive benefits: mental health, maternity, and chronic conditions.

- Mental health coverage has expanded, yet limits and session caps still vary; verify whether psychiatrists and counsellors are billed as specialists and whether teletherapy is included.

- For maternity, plan ahead—waiting periods can be 10–12 months.

- For chronic conditions, understand whether coverage is moratorium-based or fully underwritten, and how that affects ongoing medications and specialist follow-ups.

Renewal as a design opportunity

If you already have a plan, treat your next renewal as a chance to tune it. Ask: Does my zone of cover reflect where I will actually be? Are my key clinics and hospitals in-network with direct-billing? Are evacuation arrangements clear and current? Do maternity, mental health, and chronic-care benefits match our life plans? How are claims handled when I cross borders mid-treatment? The answers will tell you whether you have insurance—or assurance.

From default to design: what great expat cover feels like

Ultimately, the promise of an international life should include healthcare that feels familiar wherever you are. That requires a partner who knows insurers’ policy wordings and the on-the-ground realities of healthcare systems worldwide. It requires design, not default; stewardship, not sales; and a commitment to keep your coverage evolving with your life.